The Takeaway

Overall index success rates declined, with 26% of sustainability indexes outperforming their non-ESG equivalents in 2025 versus 45% in 2024, reflecting a challenging environment for most ESG aligned approaches.

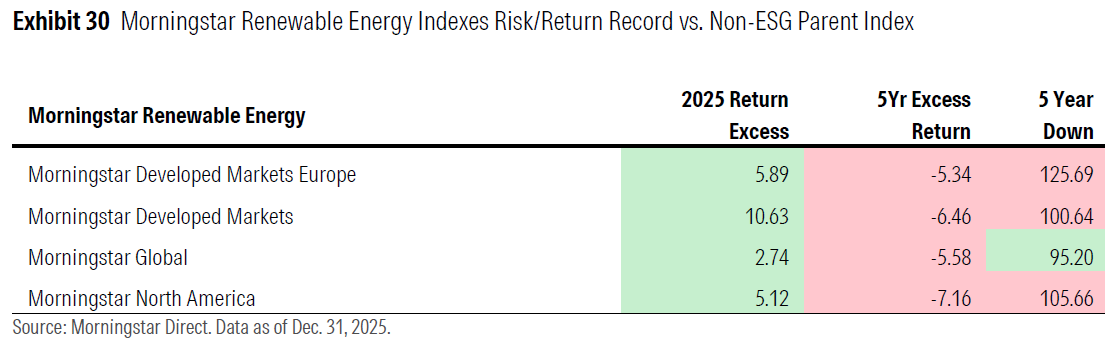

Five factors explained 2025 outcomes, led by the impact of mega cap concentration, Alphabet exclusions, a renewable energy rebound, strong returns from carbon intensive sectors, and underexposure to financials and defense outside the US.

A concentrated, AI driven market led by a small group of mega caps created broad headwinds for sustainability indexes, with structural underweights and exclusions driving most relative underperformance.

For the third consecutive year, global equity markets were led largely by a small group of mega cap companies largely tied to the artificial intelligence theme. Their outsize influence created a market environment where outperforming a broad benchmark became increasingly difficult for any approach that didn’t fully embrace this concentrated leadership.

Sustainable investing is not monolithic, which becomes clear when examining the dispersion of returns across Morningstar’s sustainability index ranges. Morningstar segments its sustainability index range into three categories: Climate, ESG Risk, and Impact Aligned.

Each group uses materially different sustainability data and pursues unique outcomes. Unlike in previous years, such as 2024, when climate indexes soared, all three categories struggled on a relative basis. A clear trend emerged in 2025: indexes with high relative active share, or those that are materially different from their benchmarks, struggled on a relative basis. This highlights the importance of portfolio construction and of understanding active bets against a benchmark.

For sustainability indexes, that challenge was especially acute. In 2025, relative performance was the second-worst year since this study began in 2018, behind only 2022. Historically, indexes centered on environmental, social, and governance factors tend to perform better during periods when less carbon intensive sectors, such as technology and communication services, lead equity markets. However, concentration in global equity market leadership in 2025 led to uneven performance across sustainability indexes.

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.