The Takeaway

A change in market direction in the third quarter of 2024 saw a comeback for previously out-of-favor factors, like size (small caps), yield, and value. Value and yield also bounced back in 2022 and 2016. Meanwhile, low-volatility stocks showed resilience amid market volatility in the third quarter of 2024, just as they did in the down markets of 2022 and 2018.

The quality factor hit a speed bump in the third quarter of 2024, coming off a market-beating 10-year run, as well as outperformance in 2023 and the first half of 2024.

Momentum, which rode the quality wave in 2024's first half, has been tripped up by a change in market direction. This behavior is consistent with previous market inflection points.

Investors hoping for a quiet summer have been disappointed. The ascendant equity market of 2024's first half, buoyant on the promise of artificial intelligence, ran into turbulence in the third quarter. An unexpected rate hike in Japan and concerns over the US economy, interest rates, earnings, and valuations all contributed. Volatility spiked. Market leadership rotated.

Will the third quarter of 2024 be remembered as a minor blip or an enduring turning point? Only time will tell. But market behavior, when viewed through the lens of Morningstar Global Factor Indexes, reveals timeless patterns.

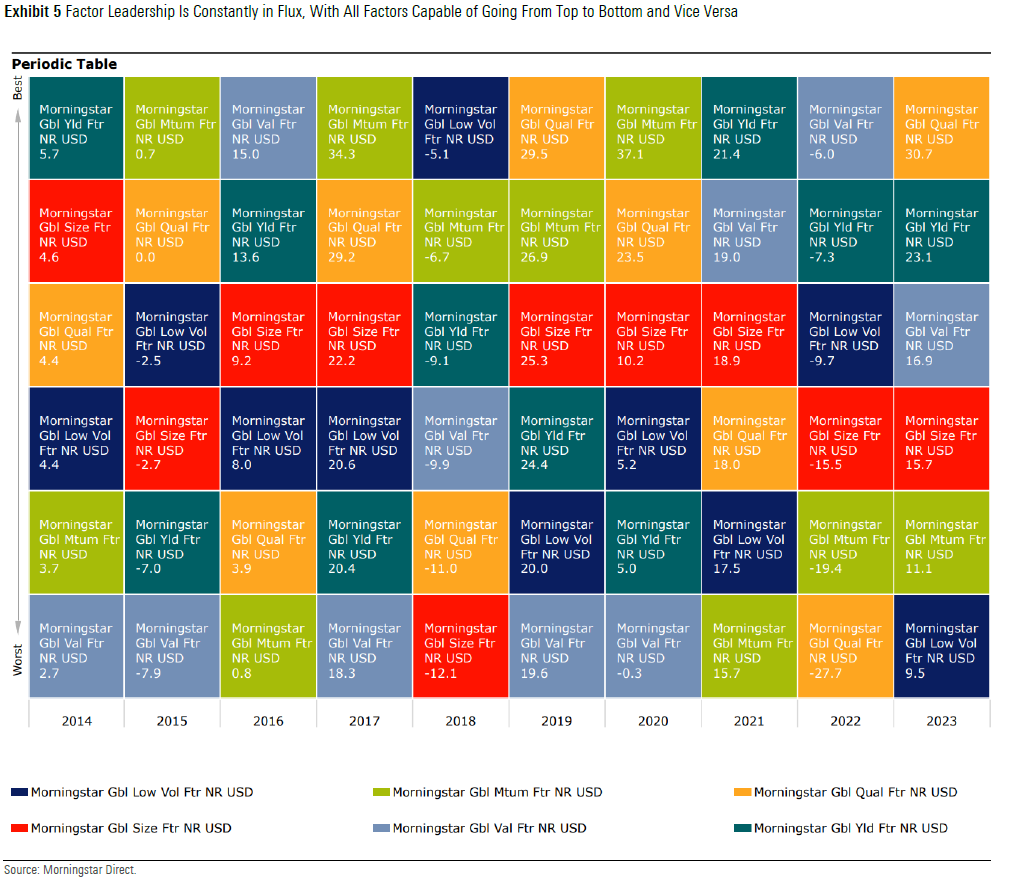

A Periodic Table of factor returns shows that leadership is highly variable. Single factor investing requires patience. For investors who can't stomach prolonged underperformance, factor diversification is sensible.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.