The Takeaway

After struggling in 2022, quality companies were underestimated and undervalued. They have led the market in 2023.

Low-volatility stocks have lived up to their reputation for displaying resilience in risk-off market environments (2022) but sluggishness in up markets (2023).

Momentum—the best-performing factor for the trailing 10 years—underperformed in both 2022 and 2023, demonstrating its susceptibility to getting tripped up by changes in market direction.

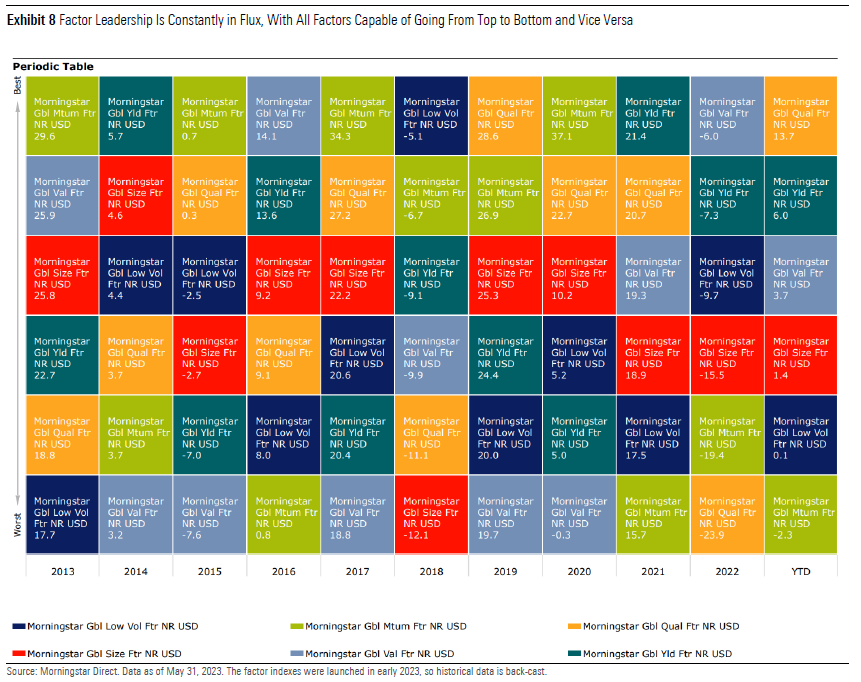

Morningstar Global Factor Index returns reveal a dramatic reversal in equity market leadership over the past 18 months. Stocks exhibiting "quality" characteristics are leading this year after falling further than the broad market in 2022. By contrast, the value and low-volatility factors held up relatively well in the difficult conditions of 2022 but have struggled on a relative basis so far in 2023. Momentum stands out for underperforming in 2022 and lagging in 2023, living up to its reputation for stumbling as a result of changes in market direction.

Momentum strategies target stocks with strong recent returns, based on the premise they are likely to continue to outperform. A pitfall of momentum investing, however, is that it is prone to underperformance after inflection points. At its December 2022 reconstitution, the Morningstar Global Momentum Factor Index jettisoned stocks like Apple, Microsoft, Tesla, and Nvidia, because of a relative slowdown in their returns. All went on to become big winners in 2023, as the quality factor has led the market. Meanwhile, several of the momentum index’s top constituents—names like Exxon, Chevron, and United Health—are in negative territory this year, as value stocks have lagged.

Over the past ten years, momentum is the best performing factor. But Morningstar factor index returns show that leadership is constantly in flux. Factor investment requires patience; cyclicality is a feature not a bug.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.