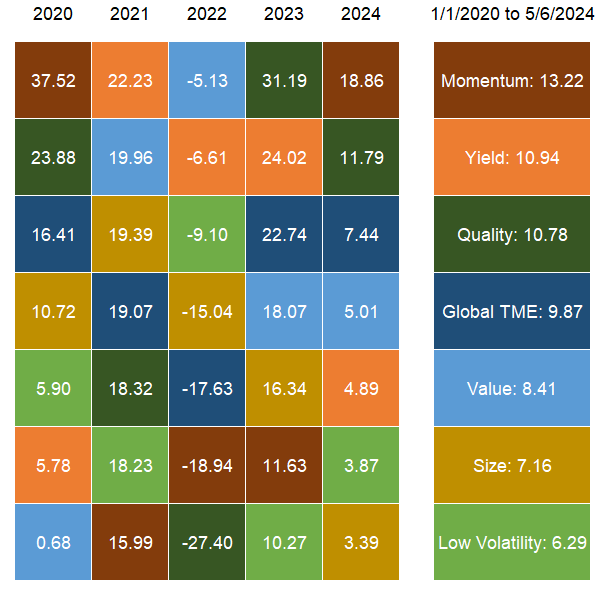

Stocks with strong momentum characteristics have jumped into the lead in 2024 after three years of underperformance. An 18.9% return through May 6 for the Morningstar Global Momentum Factor Index has been driven by favorable exposure to stocks in the technology, healthcare, and industrials sectors. The quality factor has also performed well in 2024, while low-volatility stocks have been out of favor. This divergence throws cold water on the perception that these two factors provide similar exposure, according to new insight from Morningstar Indexes.

The Morningstar Global Quality Factor Index has risen nearly 12% year to date through May 6, outperforming the Morningstar Global Target Market Exposure Index by more than four percentage points. The Morningstar Global Low Volatility Factor Index, on the other hand, has risen just 3.9% in 2024, underperforming the Morningstar Global Target Market Exposure Index by 3.5 percentage points.

Morningstar Factor Index Returns: 2020-2024

Alex Bryan – Director of Equity Product Management, Morningstar Indexes

“Factors, which on the surface, may seem similar can behave differently in different market regimes, underscoring the value of diversification across factors. The Quality Factor Index, for example, targets stocks with high profitability and strong balance sheets. Examples of stocks currently exhibiting those characteristics include Nvidia, Alphabet, and Meta, which have performed well this year. While this index offered some relief during the flight to quality that occurred during the global financial crisis and Covid sell-off, it has little overlap with the Low Volatility Index. That index seeks companies with low historical volatility, which tend to have less cyclical cash flows than most in the Quality Factor Index and catch less of the market’s upside. Current constituents of the Low Volatility Index include consumer defensive names like Johnson & Johnson and Nestle, which have not performed well this year.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.