A lack of liquidity, scarce opportunities for exits through public listings, and a flight to quality have slowed the creation of private companies with valuations exceeding $1 billion in 2024. This comes as the late-stage venture capital market has suffered from constrained capital availability, according to the latest Morningstar Unicorn Market Monitor.

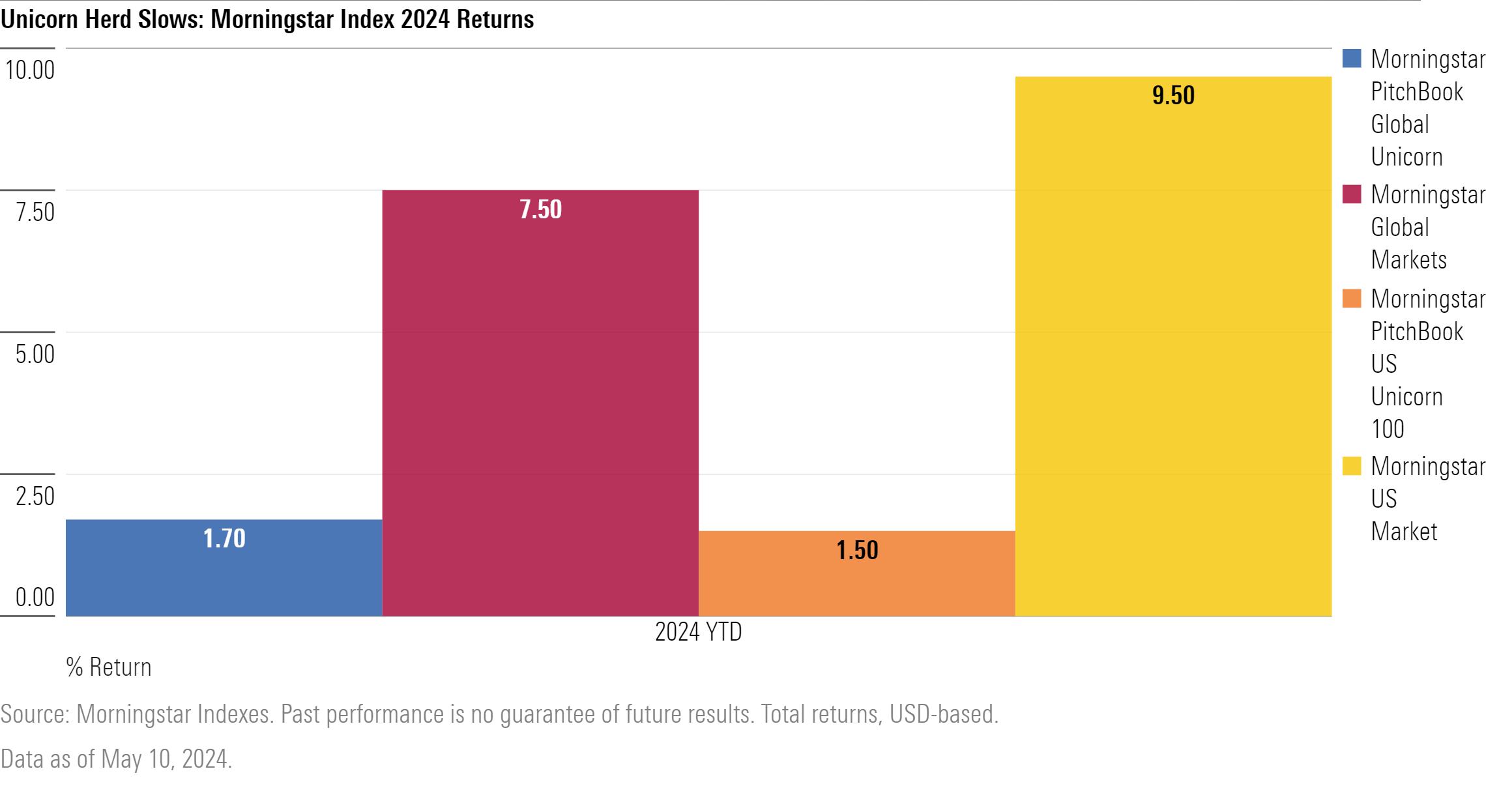

The Morningstar PitchBook Global Unicorn 500 and Morningstar PitchBook US Unicorn 100 Index have gained 1.7% and 1.5%, respectively, year to date as of May 10. This is well behind their public market counterparts, the Morningstar Global Markets Index and Morningstar US Market Indexes, which have returned 7.9% and 9.5%, respectively, for the same time period.

Only 32 new unicorns were added to the Morningstar PitchBook Global Unicorn Index in the first quarter of 2024 and only five unicorns went public. The index currently stands at 1,343 companies—almost four times that of 2018, reflecting slowing exits for late-stage VC companies via IPO.

Sanjay Arya, CFA – Head of Innovation, Morningstar Indexes:

“Investors in the late-stage venture market are exercising caution, favoring strong companies with solid financials. The bar for deals has been raised, with only the most promising opportunities attracting capital.”

Kyle Stanford, CAIA – Lead Venture Analyst, PitchBook:

“The venture capital market in early 2024 shows signs of stabilizing after two years of significant decline. However, it is still in a phase of transition as it seeks to find a new normal. Many unicorns are stuck between being too large for private funding but unable to access new capital through public offerings.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.