It’s Winter Olympics time. Get ready for some incredible feats on snow and ice, as well as weeks of flags, anthems, and exotic names. It’ll put many of us in a global mindset.

Others will have been thinking globally already, either due to recent headlines or, more pleasantly, investment returns—my topic here. As you’re probably aware, 2025 was the first year in a long, long while in which international stocks meaningfully outperformed. US investors responded with $57 billion of net inflows to international-equity funds in 2025.

Performance-chasing is inevitable. The question is whether investors are getting their timing wrong, like a downhill skier entering a turn too late. Or is upping an international allocation a belated, but ultimately winning move, like a speedskater moving into passing position on the final lap?

From ‘American Exceptionalism’ to the ‘Sell America Trade’

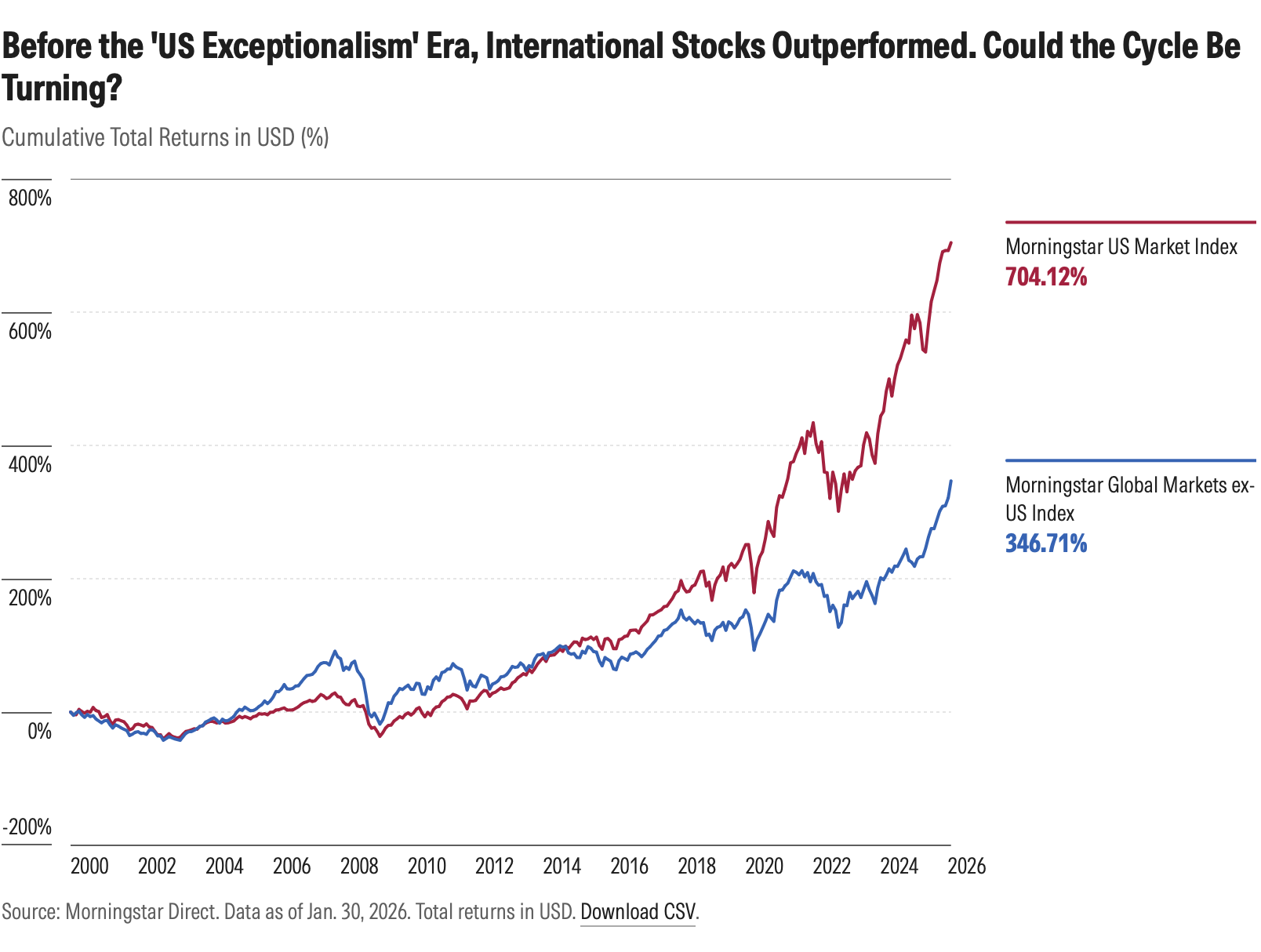

Before looking forward, let’s reflect on the performance turnaround we’ve seen for international stocks. In 2025, the Morningstar US Market Index gained an impressive 17%. But the Morningstar Global Markets ex-US Index rose 32% in US dollar terms. For a larger margin of outperformance, you’d have to go back to 2005—a time of rapid Chinese growth, European Union expansion, and US dollar weakness. One month into 2026, the trend has persisted. The international index was up 6% in January, while its US counterpart rose 1.5%.

Skeptics will look at the above graph and rightly note that international stocks have a long way to go before closing the performance gap. The US has dominated global markets since the early 2010s. An era that started with the “FANG stocks” (Facebook META, Amazon.com AMZN, Netflix NFLX, and Google GOOGL) has left eight public US companies with market values measured in the trillions. Outside the US, only Taiwan Semiconductor TSM can claim membership to the trillionaire’s club (at least when you adjust market capitalization by free-float). Corporate America has captured a disproportionate share of the spoils from technology trends like artificial intelligence.

But in 2025, talk turned from “US exceptionalism” to the “Sell America Trade.” The latter term surfaced in April of last year, after President Donald Trump’s “Liberation Day” tariff announcements sent financial markets into a tailspin. Trade policy, on top of debt and deficit concerns, prompted global investors (and central banks) to decrease their exposure to US assets. The first six months of 2025 saw the US dollar’s steepest half-year decline since 1991. Though markets rebounded, “Sell America” talk resurfaced in early 2026 amid tensions around US ambitions to acquire Greenland and more tariff threats.

I think it’s important to acknowledge that international equities’ strength owes both to US policies and endogenous factors. European markets sprang to life in early 2025, not just because of Trump-spurred defense spending but also thanks to the German election and an improved macroeconomic backdrop that was especially helpful for bank stocks. Japan’s ongoing corporate governance reforms and reflation have reinvigorated its market. In China, profitability has improved. Latin America has rallied in part because it’s a perceived winner from Trump tariffs.

Then there’s AI. You’ll notice that several of the largest companies outside the US, including Asian technology leaders and Dutch semiconductor manufacturer ASML ASML, are AI beneficiaries. It’s a global trend.

To valuation-driven investors, international stocks’ outperformance is about “reversion to the mean.” While the US market is undeniably home to some phenomenal companies, its success has also owed to “margin expansion,” or price appreciation out of proportion to fundamentals. By contrast, stocks outside the US came into 2025 cheap, whether because of elections in Latin America, Chinese property market woes, or Europe’s stagnant economy. It’s no coincidence that India, one of the most disappointing global markets in 2025, enjoyed several strong years prior.

Can International Stocks Continue Their Run?

According to Morningstar’s 2026 Global Investment Outlook: “Despite strong recent performance in non-US equities, many areas remain attractive. Emerging markets offer further potential upside, with Brazil, China, and Mexico standing out. Within developed markets, the United Kingdom and continental Europe trade at reasonable valuations.” My colleagues on Morningstar’s research and investment teams also see the US dollar as “likely entering a more prolonged period of cyclical weakness,” though, crucially, “not a secular decline.” Historically, both equity markets and currencies have gone through long performance cycles.

It’s not just Morningstar that sees more upside in international equities. Expert forecasts compiled by Christine Benz expect higher returns for non-US equities over the next decade plus. That goes for both developed and emerging markets. Return assumptions were higher last year, though, before 2025’s rally.

I was curious whether Morningstar’s asset flows data reflected the global “Sell America Trade.” Indeed, our European fund database, which also includes investment vehicles sold in certain Asian, Middle Eastern, and Latin America markets, shows that most of the fastest growing categories in the past 12 months are focused on emerging markets and European equities. Some US stock fund categories are in outflows. Whether it’s performance-chasing, diversification, or politically motivated allocations, we can only speculate.

The Myriad Benefits of Global Exposure

To me, global portfolio diversification makes long-term strategic sense (obviously, this view has cost me in recent years). I mentioned performance cycles—the 1970s, 1980s, and 2000s were all periods in which US-based investors benefited from global exposure. Currency leadership is cyclical, too. For investors worried about US politics and policy, debt and deficits, investing internationally is about hedging your bets. As I wrote about recently, international stocks have been correlated with the US. But performance has still diverged markedly.

The AI theme could contribute to further divergence. Despite some big AI beneficiaries overseas, the technology sector represents only 15% of Morningstar’s global ex-US index, compared with 33% for its US equivalent. That could be a plus or a minus. It’s a positive from a risk management standpoint, though. It’s also the case that the international equities index is less top-heavy and higher-yielding.

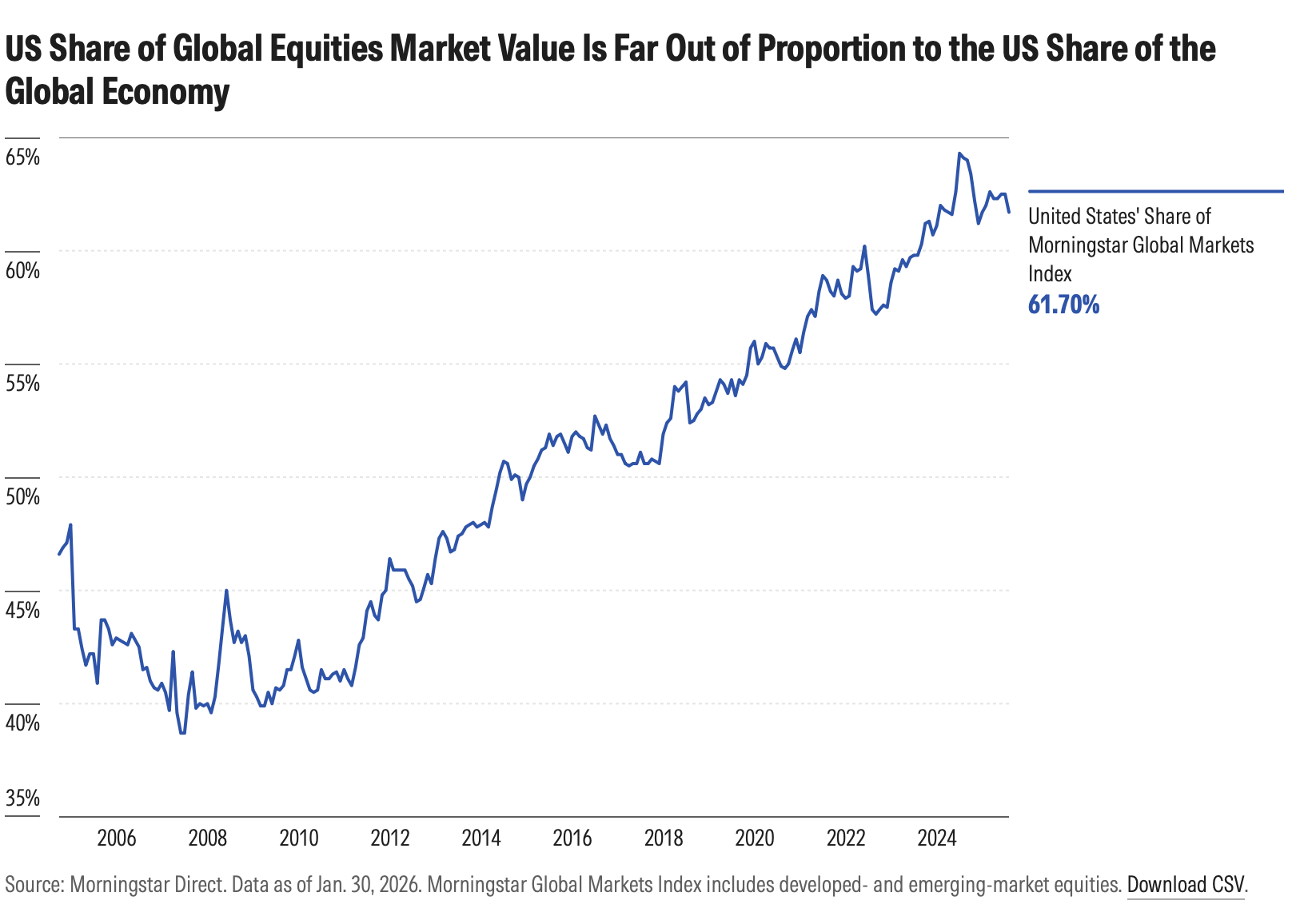

You might be aware that the US share of global equity market value is well out of proportion to its economic size. US stocks make up 62% of the Morningstar Global Markets Index of developed- and emerging-market equities, while US gross domestic product is roughly 25% of the global economy. Those numbers needn’t align. But they currently look dramatically out of whack.

While the US remains a critical market, the Olympics remind us that it’s a big world out there. Just as athletic talent is spread far and wide, the same is true of innovation and growth. No country has a monopoly on great companies. If you’re looking to invest internationally, this article is a good place to start.

I’d love to know how you’re approaching the global investment opportunity set. Feel free to drop me a line at dan.lefkovitz@morningstar.com. I read all my email even if I can’t reply to all.

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.