As originally published on Morningstar.com

The annual climate summit called COP28 has supplied reasons for both hope and dejection. It isn’t news that the world largely isn’t on track to meet the Paris Agreement’s target to limit global warming to 1.5 degrees Celsius. That’s something that Morningstar Sustainalytics’ analysis of 6,500 companies shows us. For now, companies are on track for an emissions pathway to a 3.0-degree future, which would cause some of the more catastrophic effects of climate change to kick in.

But there are plenty of venues for action by investors, large and small, and for companies, as the COP pledge to slash methane, one of the most powerful greenhouse gases, attests. And the world is moving inexorably toward creating conditions necessary for climate action. As my colleague Kunal Kapoor, Morningstar’s CEO, says, “The point is not whether the ambition is achievable, it’s that the train has left the station. Investors who treat climate transition risk as an investment risk and climate opportunities as investment opportunities are accounting for that reality.”

Kunal lays out three things you can do to consider the role of climate in your investments:

- Look beyond stated commitments to hold companies accountable for making their data transparent.

Diversify your portfolio by seeking companies with lower climate transition risk exposure.

Finally, consider how your portfolio would adapt to diverging climate outcomes. Even as the world works to mitigate climate impacts, the world is growing warmer, and climate adaptation will grow more important.

Climate finance will play a decisive role in supporting companies to mitigate and adapt to climate change.

Here, the tools are maturing. Consider the debut of the Net-Zero Data Public Utility, of which Morningstar is a member and technical advisor. It’s the first global, centralized database containing private sector climate data about emissions that are critical for the net-zero transition.

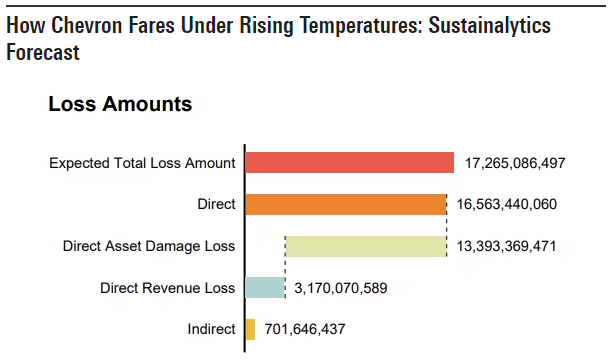

Morningstar Sustainalytics has a leadership position in our Low Carbon Transition Ratings, which provide investors with multiple signals to assess how well a company is prepared to reduce its carbon emissions. Our Physical Climate Risk Metrics also help investors assess the risks across time horizons for the physical assets of companies they own and compare exposure against a company’s peers. For example, a company like Chevron CVX is forecast to lose $13.4 billion in direct losses, led by asset damage from coastal inundation and flooding.

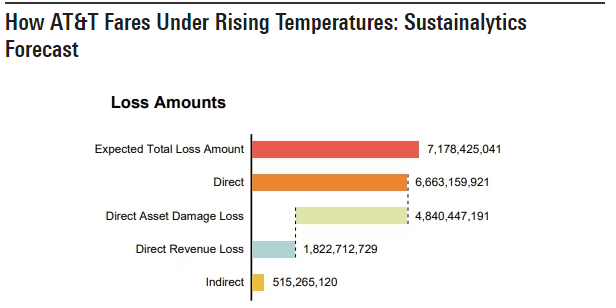

Meanwhile, AT&T is projected to lose $6.7 billion directly and $515 million indirectly.

Investors can use an assessment of high-risk assets to identify issuers who are more likely to divert their cash on hand to major capital expenditures instead of to earnings and accretive investments, for example.

It is my hope that greater transparency can help lead to investor action. As my colleague Gabriel Presler writes: “We understand the power that data and transparency hold to drive change—it’s at the heart of Morningstar’s founding more than four decades ago.”

This year, Morningstar took the major step of aligning our Morningstar Indexes and Sustainalytics under my leadership to help bring our ESG-related resources together more closely to better address the growing needs of the market. Our clients deem environmental, social, and governance metrics as ever more relevant in addressing investment risk and opportunity. Indeed, in our second annual Morningstar Voice of the Asset Owner Survey, we found that more than two thirds of asset owners (67%) believe ESG has become more material to investment policy in the past five years, with environmental factors driving materiality.

Climate is king among environmental considerations, while diversity and inclusion rank highly on the social front. While in the United States, the discussion about both is quite polarized, in Europe and the rest of the world, clients are embracing ESG and climate.

Our strategic combination provides a one-stop shop for ESG solutions for our clients, providing them with ESG ratings, research, data, and indexes. About 98% of all clients that consume ESG ratings, data, and research also use ESG indexes. We’ve built the capability to put an ESG screen on virtually any index that we calculate. That capability opens up a vast array of opportunities for investors.

These considerations may seem abstract to individual investors, who were Morningstar’s earliest customers. And many of our clients are institutional investors. But the truth is that indexes will play a big role for any investor concerned about climate change. Indexes are great tools to tell stories about the markets. They help to educate investors by providing perspective and also give easy access to investment themes in the ESG and climate space. For an individual who wants exposure to a low-carbon transition investment, for example, indexes are great vehicles for companies to create products like exchange-traded funds and mutual funds. Indeed, for people my children’s age, ESG and values-aligned investing are the norm.

So What Do I Expect for 2024?

- Investors and our other clients will keep a laser focus on climate. It will be in the forefront for years to come.

More regulations lie on the horizon as the sustainable-investing industry matures. We’ll support our clients’ needs around this. Investor demand for more transparency around greenhouse gas emissions and climate risks, and for improved climate and other governance, is growing. Consider these data points. In June, for example, the IFRS Foundation’s International Sustainability Standards Board released inaugural standards for sustainability-related disclosures. At the same time, the OECD released revised Guidelines for Multinational Enterprises on Responsible Business Conduct. In January, the Corporate Sustainability Reporting Directive entered into force in the EU, which mandates sustainable disclosures under new European reporting standards, beginning in 2024.

And this is not just in Europe. In May 2023, Canada enacted the Fighting Against Forced Labour and Child Labour in Supply Chains Act, requiring mandatory due diligence by Canada-listed companies and private companies of a certain size. And while in the US, the SEC has yet to rule on its 2022 proposal for the enhancement and standardization of climate-related disclosures, two climate disclosure laws passed by the state of California in October 2023 go further than the SEC’s proposal. They require companies to report their climate emissions, including scope 3 emissions, as well as their climate-related financial risks.

- The powerful combination of technology and artificial intelligence will also light a fire under efforts to standardize ESG information. ESG data is very different from the data we collect for a conventional index. This will enhance the quality, breadth, and depth of information that we collect, making it more standardized and usable for researchers. That will free up resources to do more value-added work for clients. It will lead to more robust climate solutions and better regulatory reporting that we can support clients with.

I began my career in conventional investing, building up a large US indexes business for Russell Investments, then helping oversee the combination with FTSE to become a leading global index provider. From how I have seen the index industry evolve in recent decades, it’s perhaps inevitable that my career has come to ESG and sustainability. You’re seeing investors move from pure cap-weighted investment vehicles into different forms of ESG investment vehicles. ESG is becoming mainstream for institutional investors as they begin to align their portfolios with the needs of their constituents and of individual investors. It’s happening already, and I think we’re going to see that accelerate.

Ron Bundy is President of Morningstar Indexes and Morningstar Sustainalytics.