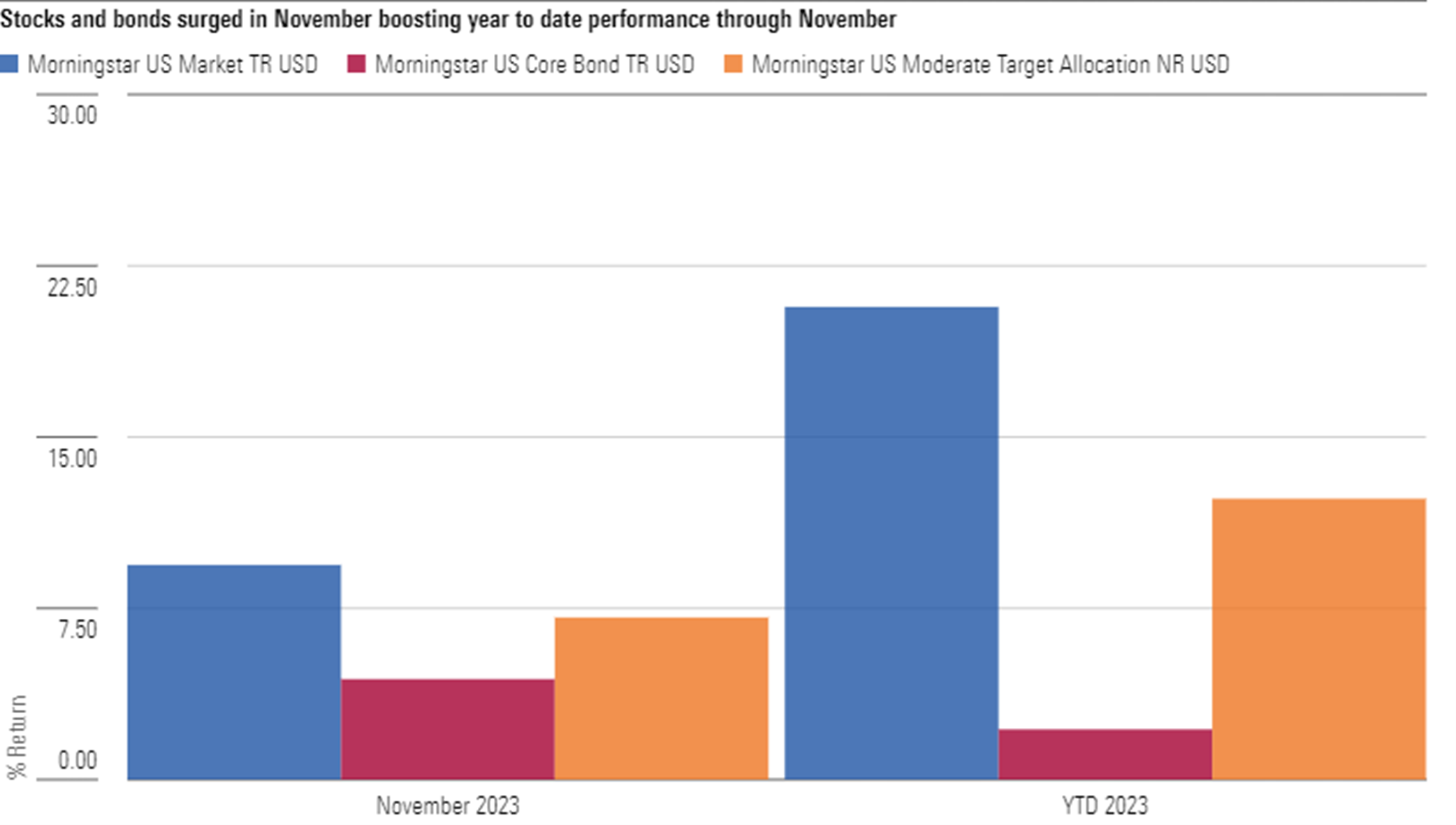

November was a great month to be a multi-asset investor. The Morningstar US Moderate Target Allocation Index, which represents the traditional mix of 60% equities and 40% bonds, gained 7.1%, its best month in 2023, on the back of strong returns for both equity and fixed income. In fact, November was the best monthly return for the index since November 2020 and only the third time in its history that it has gained more than 7% in a month.

The recent market advance is notable for its strength on both ends of the asset class spectrum. The upswing in 2023 reflects a reversal in fortune for US investors from 2022, a down year for both asset classes.

The Morningstar US Market Index, representing 97% of US equity market capitalization, rose 9.4% in November and has risen 20.5% in 2023 (as of December 5) after declining more than 19% in 2022.

The Morningstar US Core Bond Index, measuring the performance of fixed-rate, investment-grade US dollar-denominated securities with more than a one-year maturity, advanced 4.4% in November and is up 2.8% year-to-date (as of December 5), after a nearly 13% decline last year.

Dan Lefkovitz – Strategist, Morningstar Indexes, said:

“Investors are enjoying a surprisingly good year in equities, especially after November’s bump. The biggest names in the US market have done much of the heavy lifting this year.”

Katie Binns – Director, Morningstar Fixed Income & Multi-Asset Indexes, said:

“Signals that the US Federal Reserve is done raising interest rates and growing optimism for rate cuts in 2024 helped drive the November rally in equities and fixed income. After six consecutive months of losses for fixed income investors, November gains helped offset underperformance earlier in the year contributing to the strongest month of 2023 for the typical 60/40 portfolio.”

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.